摘 要

债券指数基金经过10余年的发展,已成为我国基金市场特色鲜明的重要组成部分。本文回顾了债券指数基金的发展历程,总结现阶段突出特点,分析了指数编制机构对市场发展发挥的助力作用,并就进一步发展债券指数基金市场提出了建议。

关键词

债券指数基金 债券ETF 中债指数 主题基金

债券指数基金发展历程

(一)发展伊始

自2011年市场开始出现跟踪债券指数1的债券指数基金以来,经过10余年的发展,债券指数基金已成为基金市场特色鲜明的重要组成部分。2018年以前,市场处于发展初始阶段,指数基金规模较小。据万得(Wind)数据2,截至2017年末,市场共有35只债券指数基金,总规模204亿元,平均产品规模5.8亿元,但规模中位数仅为0.59亿元。大部分指数基金至今已清算终止,但也留存下来一批经典产品,如2012年成立的首只涵盖全市场债券的综合类指数基金,其跟踪中债-新综合债券指数,目前仍然是市场上为数不多的综合类债券指数基金;2016年成立的首批国开行债券指数基金,为后续迅猛发展的政策性金融债(以下简称“政金债”)指数基金拉开序幕。

(二)初具规模

2018年债券指数基金发展迅猛,新成立债券指数基金17只。截至2018年末,债券指数基金规模已突破1000亿元,是2017年末的5倍。在此基础上,2019年债券指数基金再次取得突破式发展,年末规模达3600亿元,各期限的政金债指数基金大量成立,奠定了以政金债指数基金为主要类型的债券指数基金市场格局。2020年至2023年,债券指数基金的整体规模稳中有升,政金债指数基金仍然占据主导地位,也有部分基金管理人尝试布局地方政府债、高等级信用债和区域主题债券指数基金。截至2024年3月末,债券指数基金总规模已达6517亿元3。

经过近年的发展,目前我国债券指数基金市场已初具规模,但仍处于较为初步的发展阶段,其规模占债券型基金的比重不足10%,未来仍有较大的发展空间。

当前我国债券指数基金特点

(一)利率债指数基金为主体,期限分布以短期限为主

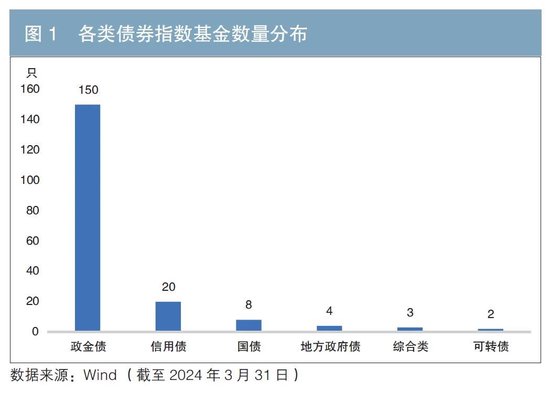

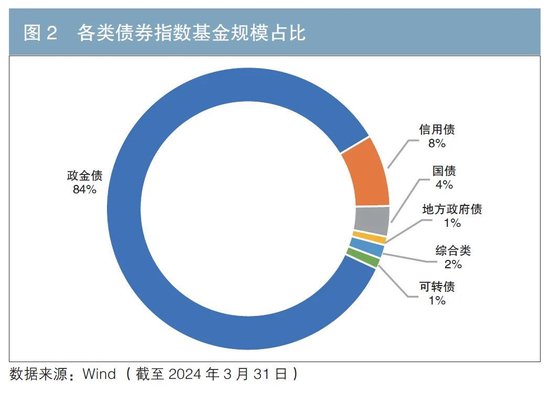

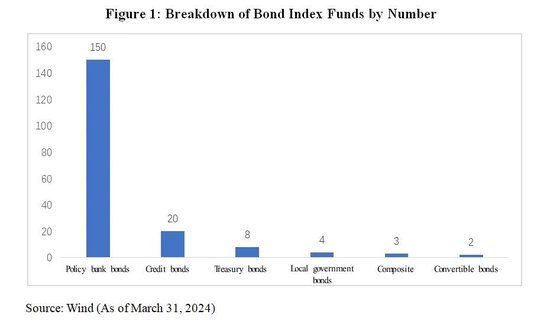

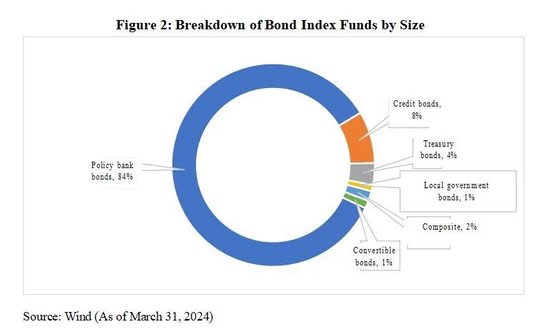

债券指数基金包括利率债、信用债及其他类型指数基金,并以利率债指数基金为主体。截至2024年3月末,全市场187只债券指数基金中,有162只为利率债指数基金,规模占比接近90%(其中,政金债指数基金150只,国债指数基金8只,地方政府债指数基金4只);信用债指数基金20只,规模占比 为8%左右;其他类型主要包括综合类债券指数基金和可转债指数基金,分别有3只和2只,规模占比较低(见图1、图2)。

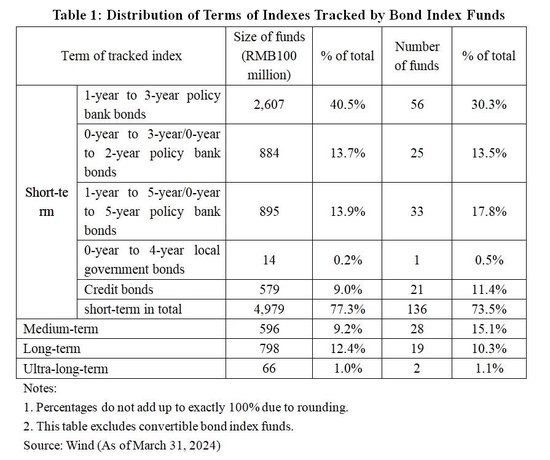

从期限上来看,债券指数基金以小于3年的短期限4为主。信用债指数基金期限全部集中在短期限。利率债方面,短期限政金债指数基金仍是市场关注的热点产品,跟踪中债估值中心、中国外汇交易中心、上海清算所、彭博等指数编制机构发布的短期限政金债指数基金具有相当规模,占比50%以上。2024年上半年,20余只短期限政金债指数基金成立,新成立的基金主要跟踪0~3年期限指数。

(二)持有人类型以机构为主,但也逐渐成为个人投资者进行资产配置的工具

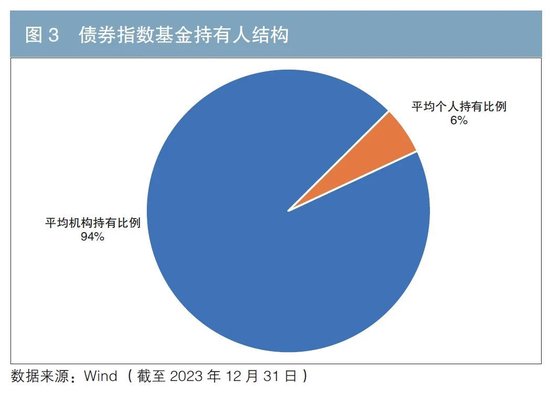

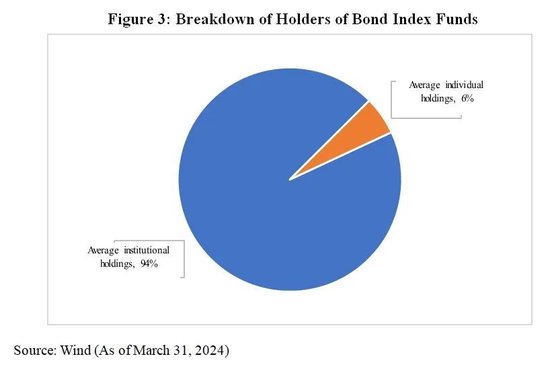

债券指数基金持有人类型以金融机构为主。根据各基金披露的2023年报,有超过85%的债券指数基金的机构持有比例在90%以上,平均机构持有比例为94%(见图3)。

虽然债券指数基金主要由机构持有,但也逐渐成为个人投资者进行资产配置的工具。个人投资者直接参与债券市场投资具有一定门槛,而债券指数基金具有透明分散的特征。随着互联网平台等基金代销渠道带动产品知名度提升,对于拥有更长历史业绩的产品,个人投资者的参与程度更高。据统计,个人投资者持有比例高于30%且基金规模大于5亿元的债券指数基金均在2019年及以前成立。个人投资者主要参与的产品类型包括中长期限利率债和综合类债券指数基金,债券指数基金相对稳定的收益是吸引个人投资者的主要因素。

(三)创新产品不断涌现

近年来,基金管理人和债券指数编制机构围绕债券指数基金进行了诸多创新尝试,尤其在债券交易型开放式指数基金(ETF)和主题类债券指数基金方面取得了一定的成绩,为投资者提供了更为丰富的选择。

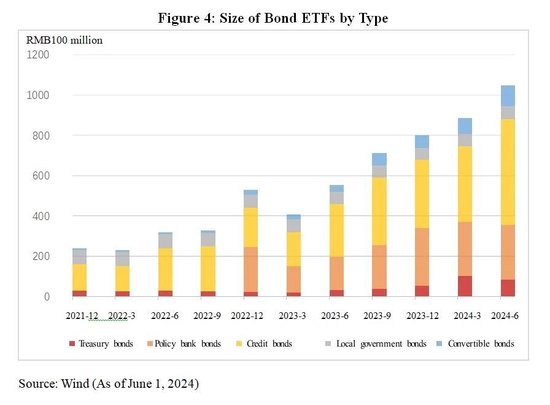

1.债券ETF规模持续上涨

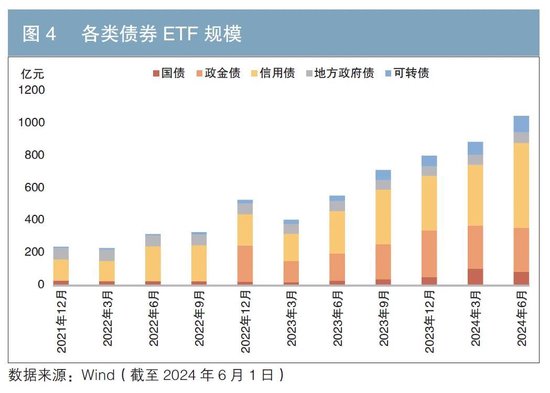

债券ETF作为可以在交易所场内二级市场买卖的债券指数基金,受益于费率优势和交易便捷,规模不断上涨。2022年5只政金债ETF成立,规模稳中有升,期限覆盖0~3年、1~5年、7~10年等各期限,进一步丰富和完善了场内工具型产品种类,为投资者提供了多样化的利率债投资选择。在超长期限债券ETF方面,近两年上市了2只跟踪30年期国债指数的债券ETF,具备清晰的长久期风险收益特征,有效填补了市场空白,受到投资者的广泛关注。截至2024年5月末,债券ETF规模突破1000亿元,标的债券种类以国债、政金债、信用债、地方政府债、可转债等为主。

2.主题类产品创新涌现

相较种类丰富的主题类股票指数基金,债券指数基金的主题类产品相对匮乏,产品类型局限在债券品种和债券期限的组合之中。而随着债券指数编制机构的指数创新,结合投资者的主题投资需求,涌现出一批受到市场认可的创新产品,包括绿色债券指数基金、优选投资级信用债指数基金、绿色普惠主题金融债券指数基金等主题产品。基金管理人布局主题类产品能够更有针对性地发挥资本市场的价值引导和资源配置作用,为相关领域引入资金支持,更好发挥金融服务高质量发展作用。

中债估值中心助力债券指数化投资

作为国内债券指数基金市场最主要的标的指数编制机构,中债估值中心自2003年开始发布市场首批人民币债券指数,长期致力于完善中债指数体系、提升指数质量、增强指数研发能力,编制了一系列能够反映人民币债券市场、具备表征性和可投资性的指数。伴随着国内债券指数基金市场的兴起和发展,中债指数已成为中国境内历史悠久、应用广泛、产品数量众多的人民币债券指数品牌,在债券指数化投资的各方面为市场提供专业服务。

(一)做好金融“五篇大文章”,持续丰富指数族系

为响应高质量发展要求,中债估值中心积极拓展金融支持重要领域实体经济渠道,将科技金融、绿色金融、普惠金融、养老金融、数字金融“五篇大文章”与指数产品编制相结合,为市场投资者提供可落地、可执行的指数化投资解决方案。

一是不断完善中债绿色及可持续发展系列指数体系,编制发布绿色债券系列指数,满足绿色债券指数基金跟踪需求。基于中债环境、社会和公司治理(ESG)评价体系编制发布中债-ESG优选信用债指数,以及10余只与市场机构合作的ESG债券指数。

二是推出科技创新系列债券指数,刻画科技创新主题债券的回报表现和收益特征,为投资者参与科技创新信用债券投资提供参考和专业化工具。

三是在普惠金融推进全面乡村振兴战略实施方面,中债估值中心已发布4只乡村振兴主题指数,引导资金流入乡村振兴实施项目,助力农业农村现代化建设。

四是与市场机构联合发布年金基金债券指数,在养老金指数化投资方面进行开创性探索。

此外,中债估值中心依托债券基础信息数据积累,针对性识别科技、绿色、普惠、养老、数字相关债券作为指数成分,进一步为债券指数基金和机构定制合作主题类产品提供指数编制服务,推动金融高质量发展。

(二)提供基金份额参考净值(IOPV)、业绩归因等指数投资衍生服务

为满足市场对于指数投资衍生服务的需求,中债指数陆续推出IOPV、债券业绩归因、指数业绩归因等数据服务,为债券指数基金和债券ETF的投资决策及业绩评价提供参考。

一是上线债券ETF的IOPV计算服务。IOPV作为ETF盘中投资交易的参考指标,对于提高ETF交易透明度和交易活跃度具有重要作用。中债估值中心在2024年4月正式上线债券ETF的IOPV计算服务,首批服务对象为在深圳证券交易所上市交易的华安中债1-5年国开行债券ETF(159649)、博时中债0-3年国开行债券ETF(159650)和平安中债0-3年国开行债券ETF(159651),首次覆盖政金债ETF,填补了相关市场的空白。

二是推出业绩归因数据服务。为满足投资者分析投资组合业绩来源、衡量投资组合业绩表现的需求,中债估值中心于2021年推出中债业绩归因产品,包括单券业绩归因、指数业绩归因和投资组合业绩归因计算工具,投资者可根据持仓进行业绩归因计算,并与指数基准进行比较。业绩归因框架主要基于Campisi模型,将债券收益归因为持有收益、无风险利率(国债收益率曲线)变动收益、个券风险(信用利差)变动收益三大类共11项因子,为债券指数化投资的收益来源拆解和业绩比较评价提供更为丰富翔实的分析数据。

(三)建设中债DQ金融终端指数投研模块,提供指数化投资便利工具

目前,中债指数已发布超过1500只各类指数,为方便基金管理人和投资者日常应用指数数据和获取指数信息,中债DQ金融终端围绕中债指数应用场景持续进行开发优化。

一是在客户端提供丰富全面的指数基础指标、统计分析等数据,支持多指数历史收益风险数据对比分析。

二是从资产类别、热点主题、样本期限、信用评级等数十个维度提供指数筛选功能,帮助使用者迅速定位所需要的指数信息。

三是内嵌指数计算器功能,可在线利用中债指数同源数据库进行自定义规则指数历史回测,为策略验证提供支持。

四是可以便捷查询下载指数衍生服务的深度数据,例如业绩归因、IOPV等相关数据。

进一步推动债券指数基金发展的建议

一是进一步丰富债券指数基金类型。目前债券指数基金品种相对集中在利率债品类,较为缺少综合类、信用类及主题类产品。参考境外市场,投资者对于投资债券市场的工具型产品需求较大,如贝莱德美国债券综合指数ETF的规模达1048亿美元5,可作为投资者参与整体债券市场投资的一键式配置工具,被广泛使用在投资顾问6的资产配置策略中。建议进一步布局综合类和信用类债券指数基金,为各类投资者提供丰富便捷的债券市场配置工具。另外,随着科技、绿色、普惠等主题类债券的不断发行和丰富,相关债券指数也已陆续发布,主题类产品的进一步发展已具备先决条件,部分金融机构已开始推动主题类债券指数基金的创设与投资。建议进一步加大力度推动主题债券指数基金和债券ETF发展,引导资金投入相关领域,做好金融“五篇大文章”,推动经济高质量发展。

二是优化债券指数基金投资者结构。作为债券市场的主要参与者,金融机构在债券指数基金的投资参与中具有先天优势,形成了以银行类金融机构为主的债券指数基金投资者结构。进一步发展壮大债券指数基金市场离不开更加丰富多元的投资者结构。在金融机构中,养老金、年金和保险资金等中长期资金的投资需求能够引导产品期限结构均衡发展,改善短期限产品过度集中的情况。境外投资者近年来对于中国债券市场的投资热度不减,但较少通过债券指数基金进行投资。建议将债券指数基金纳入基金互认、ETF互挂、跨境理财通等跨境互联互通业务,促进境外投资者投资境内债券指数基金。债券指数基金为个人投资者提供了低门槛的债券市场投资参与机会,建议通过基金销售平台等渠道宣传加强个人投资者对于债券市场和债券指数基金的了解,逐步培养投资配置意愿和能力,创设适配个人投资者风险偏好的债券指数基金。

注:

1.2003年成立的长盛全债指数增强基金业绩比较基准为债券指数与股票指数的组合,作为债券指数增强基金,本文未将其纳入债券指数基金范围。

2.本文数据除特殊说明,均来源于Wind。

3.本文针对债券指数基金各项统计分析数据均不包含同业存单指数基金。

4.本文短期限为指数平均久期小于3年,中期限为指数平均久期3~5年,长期限为指数平均久期5~10年,超长期限为指数平均久期10年以上。

5.数据来源:BlackRock,截至2024年3月31日。

6.该产品70%的投资者为投资顾问。投资顾问公司主要提供投资建议和管理服务,类似国内的证券公司投资顾问部门、私人银行部门、专业第三方理财咨询公司。根据美国投资顾问协会(Investment Adviser Association)2023年报告,投资顾问行业管理规模达到114.1万亿美元,全美有15114家注册投资顾问公司,全行业90.6%的资产集中于管理规模在50亿美元以上的大公司。

参考文献

[1] 陈子越,曹阳.中国债券指数基金发展回顾及前景展望[J].中国货币市场,2023(4).

[2] 厉海强.中外债券指数基金产品对比及启示[J]. 债券,2020(10).DOI: 10.3969/j.issn.2095-3585.2020.10.017.

[3] 廖倩芸,盛晓虹,孙若阳.指数化投资:中国债券市场投资新视角[J]. 债券,2020(11).DOI: 10.3969/j.issn.2095-3585.2020.11.016.

◇ 本文原载《债券》2024年7月刊

◇ 作者:中债金融估值中心有限公司指数部 葛量

◇ 编辑:廖雯雯

Analysis of China Bond Index Fund Market Development

Ge Liang

Abstract

After development for more than a decade, the bond index funds have become an important and distinctive part of China’s fund market. This paper reviews the history of bond index funds, summarizes their prominent characteristics in the current stage, analyzes the index providers’ role in driving market development and gives suggestions on advancing the bond index fund market.

Keywords

Bond index funds, bond ETF, ChinaBond indexes, thematic funds

History of Bond Index Funds

i. Beginning

Since the first bond index fund tracking a bond index1 emerged in 2011, the bond index funds have become an important and distinctive part of China’s fund market. The market was in its infancy before 2018 with a small size of index funds. According to Wind data2, there were 35 bond index funds in the market as at the end of 2017 with a total scale of RMB20.4 billion, averaging RMB580 million per product, in sharp contrast to a median of merely RMB59 million. Most of these index funds have been liquidated and terminated so far, but a number of classic products are still in existence. For example, the first composite index fund covering all bonds in the market, established in 2012 to track the ChinaBond New Composite Index, remains one of the few general bond index funds available in the market now. The first group of CDB bond index funds created in 2016 ushered in a boom of the policy bank bond index funds.

ii. Thriving

Bond index funds thrived in 2018, with 17 products created in the year alone. As at the end of 2018, bond index funds broke the mark of RMB100 billion, five times that in 2017. The year 2019 saw bond index funds make leapfrog moves and hit a size of RMB360 billion at the end of the year, with policy bank bond funds of various tenors established to shape a market landscape dominated by policy bank bonds. The size of bond index funds expanded steadily from 2020 to 2023, while policy bank bonds still dominated the market. Some fund managers tried making a foray into local government bonds, high-grade credit bonds and regional themed bond index funds. As at the end of March 2024, the total scale of bond index funds reached RMB651.7 billion3.

China’s bond index fund market has had a fairly large scale now after its rapid development in recent years, yet still in the early stage. Accounting for less than 10% of the bond fund market, bond index funds still see vast space of growth.

Characteristics of China’s Bond Index Funds at Present

i. Interest rate bond index funds and short terms are the majority

The bond index funds include interest rate bond index funds, credit bond index funds and others, among which the interest rate bond index funds take the lion’s share. As of the end of March 2024, 162 of the 187 bond index funds in the market are interest rate bond index funds (including 150 policy bank bond index funds, 8 treasury bond index funds, and 4 local government bond index funds), accounting for nearly 90% of the total. There were 20 credit index funds, accounting for about 8%. Others were 3 composite bond index funds and 2 convertible bond index funds, representing a fairly low proportion (see Figure 1 and Figure 2).

By terms, bond index funds are mainly short-term4 (less than 3 years). In particular, all credit bond index funds fall in the category of short terms. In terms of interest rate bonds, short-term policy bank bond index funds remain the focus of market participants. The short-term policy bank bond index funds tracking the bond indexes published by ChinaBond Pricing Center, China Foreign Exchange Trade System, Shanghai Clearing House and Bloomberg have reached quite a large scale, accounting for over 50% of the total. In the first half of 2024, more than 20 short-term policy bank bond index funds were established, which mainly track 0-year to 3-year indexes.

ii. Bond index funds are held mainly by institutional investors, with a growing share held by individual investors

The holders of bond index funds are mainly financial institutions. According to the 2023 annual reports disclosed by funds, over 85% of bond index funds were over 90% held by institutions, with the institutional holdings averaging 94% (see Figure 3).

Bond index funds, though held mainly by financial institutions, are gradually becoming a component of individual investors’ portfolio. Individual investors have to meet certain threshold to directly participate in the bond market, while bond index funds are transparent and decentralized. As online platforms and other distribution channels boost the visibility of fund products, the products with a longer track record see greater participation by individual investors. According to statistics, all the bond index funds with a size of over RMB500 million and more than 30% held by individual investors were established in 2019 or before. Individual investors mainly participate in medium-/long-term interest rate bond funds and composite bond index funds. The relatively stable return on bond index funds is the major appeal to individual investors.

iii. Innovative products are mushrooming

In recent years, fund managers and bond index providers have made many innovative attempts on bond index funds. In particular, they have made achievements in bond ETFs and thematic bond index funds.

1. Bond ETFs have been expanding in size

Bond ETFs as bond index funds traded on the secondary exchange market have seen their scale expanding on lower fee rates and convenient trading. Five policy bank bond ETFs were created in 2022, with the size increasing steadily and the terms covering 0-3 years, 1-5 years and 7-10 years. These products have further added to exchange-traded instruments, providing investors with a variety of interest rate bond funds. In terms of ultra-long-term bond ETFs, two ETFs tracking 30-year treasury bonds were launched in the past few years, showing clear risk-return characteristics of long duration, filling the market gap and drawing wide attention among investors. As of the end of May 2024, bond ETFs exceeded RMB100 billion in size, with the underlying bonds mainly being treasury bonds, policy bank bonds, credit bonds, local government bonds and convertible bonds.

2. Innovative thematic products have surged

Compared with the wide variety of thematic equity index funds, the thematic bond index funds are relatively limited, with the product category simply being a combination of bond type and bond term. However, a large number of innovative products recognized by market participants have emerged amid the index innovations by bond index providers and investors’ demand for thematic investment. These innovative products include green bond index funds, selected investment-grade credit bond index funds and green and inclusive financial bond index funds. With an exposure to thematic products, fund managers will give better play to the role of capital markets in guiding value and allocating resources, channeling capital into relevant sectors and better serve high-quality development.

ChinaBond Pricing Center Has Given a Boost to Bond Index-based Investment

As the major index provider in China’s bond index fund market, ChinaBond Pricing Center issued the first batch of RMB bond indexes in 2003. The center has been long dedicated to improving the ChinaBond index series, improving the quality of indexes and enhancing its index research and development capability. It has compiled a series of indexes with representativeness and investability that mirror the RMB bond market. With the domestic bond index fund market emerging and growing, ChinaBond indexes have become a RMB bond index brand featuring a long history, extensive application and numerous products, providing professional services for the market in every respect of bond index-based investment.

i. Continuing to expand the index families with a focus on Five Priorities

To meet the requirements of high-quality development, ChinaBond Pricing Center has expanded the channels of financial support for important sectors of the real economy, and aligned the compilation of indexes with the Five Priorities, that is, technology finance, green finance, inclusive finance, pension finance and digital finance, providing investors with viable index investment solutions.

First, ongoing improvements have been made to the ChinaBond Green and Sustainability Index series, with green bond indexes compiled and published to meet the tracking needs of green bond index funds. The center compiled and issued the ChinaBond ESG Select Credit Bond Index and over ten ESG bond indexes in cooperation with market entities.

Second, the technological innovation bond index series was launched to reflect the return and yield performance of technological innovation-themed bonds, providing a reference and professional tool for investors to invest in technological innovation credit bonds.

Third, in terms of inclusive finance driving implementation of the rural revitalization strategy, ChinaBond Pricing Center has issued four rural revitalization indexes guiding capital flows into rural revitalization projects, thereby contributing to the agricultural and rural modernization.

Fourth, annuity fund bond indexes were launched jointly with market entities, representing groundbreaking explorations in pension index-based investment.

ChinaBond Pricing Center has identified technological, green, inclusive, pension and digital bonds as index constituents based on its basic bond data accumulation, and provided index services for cooperative thematic products customized for bond index funds and institutions, giving an impetus to high-quality development of financial services.

ii. Providing index investment derivative services such as indicative optimized portfolio value (IOPV) and performance attribution

To meet the market demand for index investment derivative services, ChinaBond Indexes have launched IOPV, bond performance attribution, index performance attribution and other data services to provide reference for investment decision making and performance evaluation relating to bond index funds and bond ETFs.

First, the IOPV calculation service for bond ETFs has been launched. As a measure of an ETF’s intraday value, IOPV plays an important role in improving the transparency and activity of ETF transactions. ChinaBond Pricing Center officially launched the IOPV calculation service of bond ETFs in April 2024. The first group of served ETFs are HuaAn ChinaBond 1-5 Year CDB Bond ETF (159649), Bosera ChinaBond 0-3 year CDB Bond ETF (159650) and Ping An ChinaBond 0-3 year CDB Bond ETF (159651) listed on the Shenzhen Stock Exchange, covering for the first time the policy bank bonds ETFs and filling the gap in the related market.

Second, the performance attribution data service was launched. In order to meet investors’ needs to analyze the source of portfolio performance and measure the performance of portfolios, ChinaBond Pricing Center launched ChinaBond performance attribution products in 2021, including calculation tools for bond performance attribution, index performance attribution and portfolio performance attribution, allowing investors to calculate performance attribution based on their holdings and compare them with the index benchmark. The performance attribution framework is mainly based on the Campisi model, attributing bond returns to 11 factors in three categories: holding period return, return on risk-free interest rate (treasury yield curve) change, and return on bond risk (credit spread) change, providing more thorough and detailed analysis data for the yield breakdown and performance comparison of bond index-based investment.

iii. Developing the ChinaBond DQ financial terminal index investment and research module to provide index-based investment facilitation tools

At present, over 1,500 ChinaBond indexes have been released. In order to facilitate fund managers and investors in day-to-day access to and use of index data, the ChinaBond DQ financial terminal continues with development and optimization relating to the application scenarios of ChinaBond indexes.

First, a full range of basic index indicators and statistical analysis data are provided on the ChinaBond DQ to support the comparative analysis of multi-index historical return and risk data.

Second, an index screening function is provided under dozens of dimensions, including asset class, hot topics, terms of constituents and credit rating, helping users quickly locate the index information they need.

Third, the index calculator function is embedded to enable index backtesting under customized rules using the ChinaBond index homologous database online, providing support for strategy verification.

Fourth, the in-depth data on index derivative services are available for inquiry and downloading, such as performance attribution and IOPV data.

Suggestions on Promoting Development of the Bond Index Funds

First, more types of bond index funds should be introduced. At present, bond index funds are concentrated in the interest rate bond category, showing a lack of composite, credit and thematic categories. As seen in overseas markets, investors have a huge demand for instruments designed to invest in the bond market. For example, the size of the BlackRock iShare Core U.S. Aggregate Bond ETF has reached USD104.8 billion5, which can serve as a one-click allocation tool for investors to participate in the bond market and is widely used in the asset allocation strategies of investment advisors6. It is suggested to develop composite and credit bond index funds to provide investors with a wide range of convenient tools for bond allocations. In addition, with a growing variety of thematic funds including technological, green, and inclusive bonds issued, relevant bond indexes have also been released one after another. Seeing thematic products ready for further development, some financial institutions have begun their push for creation and investment of thematic bond index funds. It is suggested to strengthen efforts to develop thematic bond index funds and bond ETFs, channel funds into related sectors and fuel high-quality economic development with a focus on the Five Priorities.

Second, the investor base for bond index funds should be optimized. As main participants in the bond market, financial institutions have inherent advantages in bond index fund investment. A bond index fund investor base dominated by banking institutions has taken shape. Further growth of the bond index fund market cannot go without a more diverse investor base. Among financial institutions, the investment demand from medium- and long-term funds such as pensions, annuities and insurance funds will help balance the mix of product terms and ease the over-concentration in short-term products. Overseas investors have always had a keen interest in investing in China’s bond market in recent years, yet less through bond index funds. It is suggested that bond index funds be included in cross-border connectivity services such as mutual recognition of funds, cross-listing of ETFs and Cross-boundary Wealth Management Connect, so as to boost overseas investments in domestic bond index funds. Bond index funds lower individual investors’ threshold to access the bond market. It is suggested to enhance individual investors’ understanding of the bond market and bond index funds through fund distribution platforms and other channels, gradually foster their willingness and ability to invest, and create bond index funds tailored to individual investors’ risk appetite.

This article was first published on Bond Monthly ( Jul. 2024).Please indicate the source clearly when citing this article. The English version is for reference only, and the original Chinese version shall prevail in case of any inconsistency.

Notes:

1.The performance benchmark of Changsheng All Bond Index Enhanced Bond Fund, established in 2003, is a combination of bond and equity indexes. As a bond index enhanced fund, it is not included in the bond index funds in this paper.

2.Unless otherwise specified, all data in this paper are from Wind.

3.All statistical analysis data on bond index funds in this paper exclude inter-bank certificate of deposit index funds.

4.In this paper, short terms mean an average index duration of less than 3 years, medium terms mean an average index duration of 3 to 5 years, long terms mean an average index duration of 5 to 10 years, and ultra-long terms refer to an average index duration of more than 10 years.

5.Source: BlackRock, as of March 31, 2024.

6.70% of the investors in this product are investment advisers. Investment advisory companies mainly provide investment advice and management services, similar to the investment advisory departments of securities companies, private banking departments, and professional third-party financial consulting firms in China. According to the 2023 report of the Investment Adviser Association of the United States, the investment adviser industry has reached USD114.1 trillion in assets under management (AUM), there are 15,114 registered investment advisory companies in the United States, and 90.6% of the assets in the industry are concentrated in large companies with more than USD5 billion in AUM.

References

[1] Chen Ziyue, Cao Yang. Review and Outlook on Bond Index Funds in China [J]. China Money, 2023(4).

[2] Li Haiqiang. Chinese and Foreign Bond Index Fund Products: Comparison and Aspirations [J]. China Bond, 2020(10).DOI: 10.3969/j.issn.2095-3585.2020.10.017.

[3] Liao Qianyun, Sheng Xiaohong, Sun Ruoyang. Indexed Investment: A New Perspective on Investment in Chinese Bond Market [J]. China Bond, 2020(11).DOI: 10.3969/j.issn.2095-3585.2020.11.016.

◇ Author from: Index Department, ChinaBond Pricing Center Co., Ltd.

◇ Editor: Liao Wenwen

发表评论